Curi Capital

Noise and Signal

A look at markets at the end of 2021.

With the rapid rise of the 24-hour news cycle and the increasing influence of social media platforms, one challenge we face today is too much information and too many opinions. The financial markets are no exception. There are at least three television channels dedicated solely to financial news: CNBC, Bloomberg TV, and Fox Business. That doesn’t include myriad other financial media outlets, publications, research firms, podcasts, newspapers, and more.

It’s hard to imagine that investors can consume all the financial content produced in just a single day and decide what is relevant and what isn’t. With that in mind, this market commentary will offer guidance on what to ignore, what to monitor, and what to keep on your long-term radar.

WHAT TO IGNORE

Investors should largely ignore the drama of U.S. politics. Passing major legislation requires political posturing, negotiating, and debating. The difference today is that we watch it all play out in real-time through multiple media channels.

In the last few months of 2021, Congress has been fighting over raising the debt ceiling, passing a bipartisan infrastructure bill, and passing a partisan reconciliation (aka tax and spending) bill. It’s generally futile for long-term investors to worry about short-term political drama. Yes, there may be some stock market volatility in the short term, but that’s always true. The market can decline at any time for various reasons. However, the long-term trend of the stock market has been higher. Typically, markets recover relatively quickly following disruptive events.

There may be long-term consequences from the infrastructure and reconciliation bills once they become law. Curi Capital will analyze new laws and adjust our recommendations, working with clients to make any necessary modifications to long-term plans.

WHAT TO MONITOR

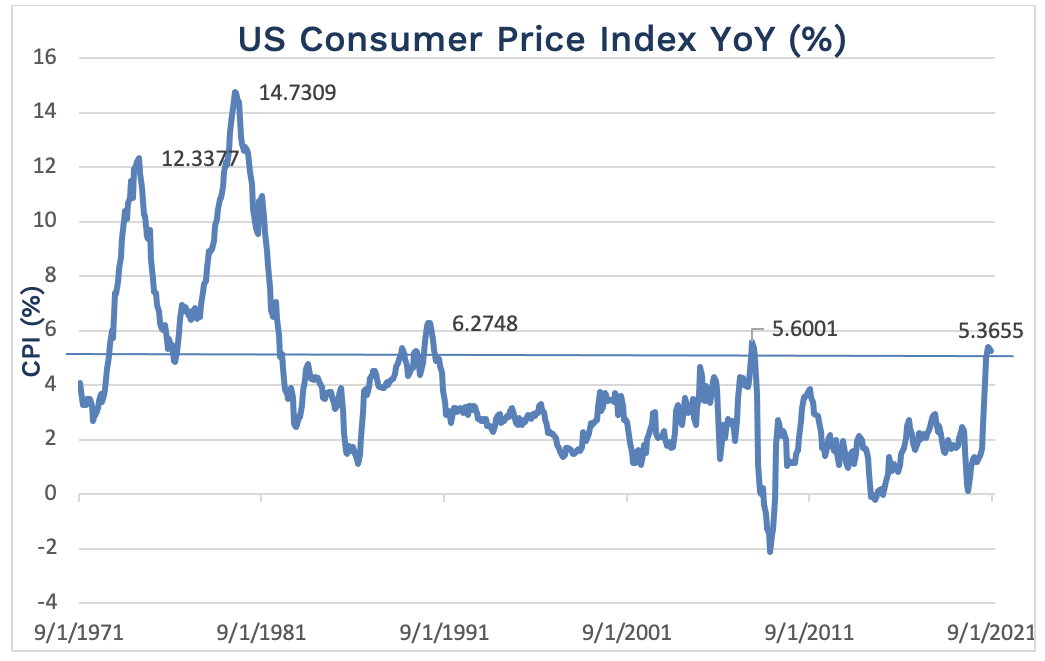

Many investors, especially retirees, are worried about inflation, as it represents a general rise in prices paid for goods and services, eroding the purchasing power of savings. This can be a scary phenomenon for retirees who need their nest egg to last their lifetime. The Consumer Price Index, which is one measurement of inflation, is over 5% for the first time in over a decade.

While inflation is elevated, we agree with the Fed that most inflation will prove transitory. Many of the forces behind elevated prices, like those tied to supply chain disruptions, should be fleeting, as they should ease in conjunction. Admittedly, the supply chain disruptions will likely last longer than we initially thought, but the pressures should ease over time.

Other forms of inflation, such as wage inflation, will be stickier. Some pressure should lessen as job openings are filled and employers figure out how to make due with fewer employees (higher productivity). However, job openings remain elevated, so increasing wages should continue, albeit at a slower pace, for some time. Overall, we expect a lower long-term inflation rate than current levels, but higher than levels before the pandemic.

Investors concerned about inflation should make sure they have a diversified portfolio, including investments that have historically done well during periods of rising inflation. Curi Capital has a number of different discretionary strategies that incorporate many different securities we expect to do well in a rising inflation environment. Strategies may include bonds with floating interest rates, real estate, and stocks.

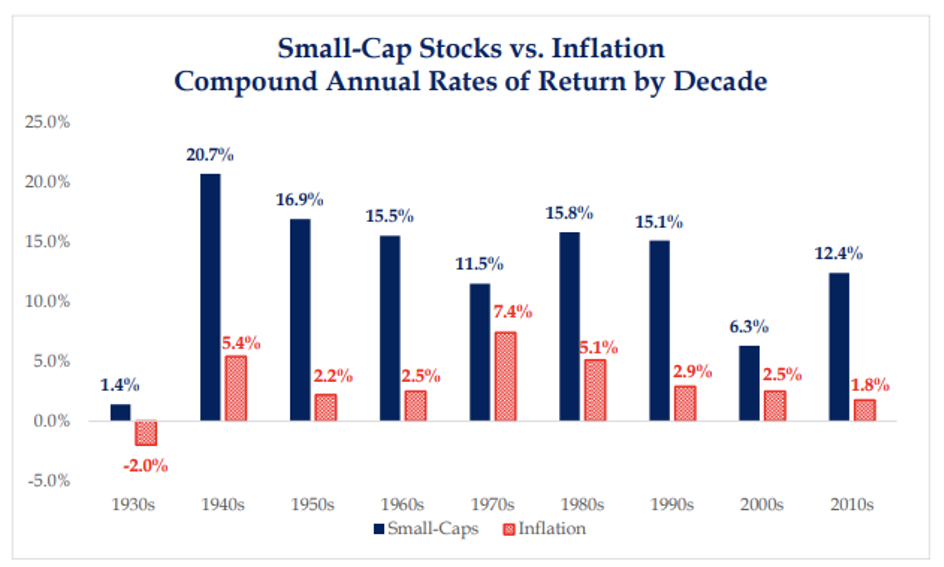

Small cap stocks, in particular, have done very well against inflation. Small companies have the ability to pass along price increases to consumers and make a much more meaningful impact to their bottom line. As the following chart shows, small-caps have outperformed inflation every decade since the 1930s.

Source: Strategas 9/15/2021

Source: Strategas 9/15/2021WHAT TO KEEP ON THE HORIZON

We think the most under-appreciated news story of the year is the regulatory crackdown in China. Chinese Premier Xi Jinping is emphasizing a “Common Prosperity” policy, introducing rules and restrictions that appear likely to dampen, if not reverse, the economic reform path China has pursued.

For example, China has fined large multinational Chinese tech firms like Alibaba, Tencent, and Didi. They’ve outlawed for-profit education companies, limited the hours kids can spend on video games per week to two hours, and have noticeably silenced several billionaires. We believe this is a long-term story with significant economic and geopolitical implications that investors must be mindful of.

The immediate impact has been significant underperformance of emerging market stocks with the MSCI Emerging Market Index, down -1.16% for the first nine months of 2021 versus 15.9% for the S&P 500 Index.1 The longer-term investment impact is unclear, although it’s not difficult to see how this could be a significant headwind to the global economy, especially for companies such as U.S. multinational corporations and countries that export to China.

PARTNER WITH YOUR FINANCIAL ADVISOR

The overwhelming abundance of information makes it nearly impossible to figure what news is significant and what can be ignored. While it’s easier to determine significance in hindsight, we believe focusing on data and taking a long-term view is the best way for Curi Capital to help our clients navigate an uncertain future.

Please note: This material should not be considered a recommendation to buy or sell securities or a guarantee of future results. Curi Capital is a registered investment advisor. Registration does not imply a certain level of skill or training. More information about Curi Capital can be found in its Form ADV Part 2, which is available upon request.

Past performance is not a guarantee of future results. All investment strategies involve risk and have the potential for profit or loss; changes in investment strategies, contributions, or withdrawals may materially alter the performance and results of a portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio. References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and indexes do not reflect the deduction of the advisor’s fees or other trading expenses.

[1] Source: Bloomberg Finance, L.P.