CORE PORTFOLIO

Our most conservative portfolio, and the basis for our solid financial foundation.

We manage our finances prudently because we know that as a member-owned company, the stability of our financial base helps us do more for your benefit. At a time of meaningful risks to the independent practice of medicine, our financial strength helps us deliver powerful, innovative solutions to the challenges you face.

We use our strong surplus position to protect the company from unexpected market challenges and invest for growth. Our capital strength allows us to create new products and services, invest in defending our medical professional liability policyholders, and grow the business in ways that can help you weather any challenges you may face.

After seeing net income drop in 2020 due factors including the challenging malpractice claims environment and premium accommodations offered to our members during the first year of the COVID-19 pandemic, the figure rebounded substantially in 2021 thanks primarily to investment returns on our publicly traded securities, private equity, and digital assets portfolios.

Our strong investment strategy and careful underwriting in Curi Insurance helped us yet again achieve positive cash flow in 2021. We use these funds to reinvest in the company as it grows, creating a positive cycle that allows us to expand our offerings to you.

The premium dollars our members entrust with Curi are an investment in this member-owned mutual company, and we are committed to sharing our success with you through our Legacy Fund and Member Dividends programs, which aim to give a substantial portion of our net income back to you as a return on that investment.

Member savings accounts with contributions that accumulate tax-deferred and pay out upon designated events, including retirement.

Annual cash payments to qualifying physicians, drawing on our financial success across the breadth of Curi Holdings, including our investments.

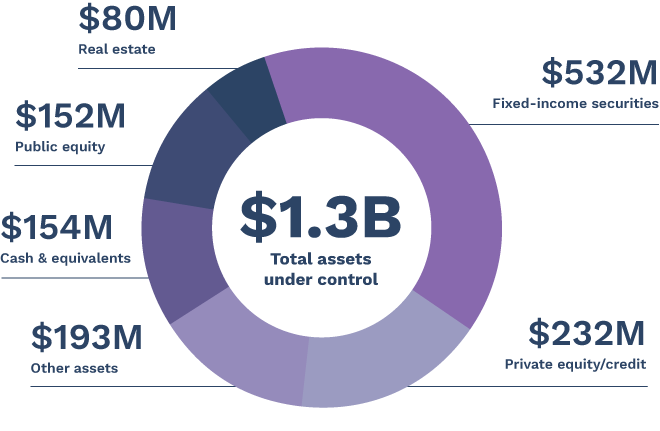

While most of our peer companies outsource investment strategy to investment consultants, we keep this process in-house—giving us greater control, greater flexibility, and greater returns. We emphasize diversification and risk mitigation in the way we invest the capital you entrust us with, and we spread that risk across three categories:

Our most conservative portfolio, and the basis for our solid financial foundation.

We invest surplus funds more aggressively, aiming to fund innovation by bringing higher returns.

A percentage of our portfolio is reserved for investment in other operating companies. Our goal here is to both generate positive financial return, enhance our capabilities and competitive advantage, and bring new services and solutions to you.